Yu Donglai found the problem at a glance.

"This is unqualified." He just stepped in.Zhengzhou Xinwan Plaza Store pointed to the pet cage at the door. This store is the first "learning from the Fat East" in Zhengzhou, and this pet cage is also an attempt to copy the characteristics of the store from the Fat East.

Yu Donglai suggested that the person in charge of the store put a layer of fine net in the pet cage, because in their experience, when customers temporarily put their pets in the pet cage, some children would go back and fiddle with it, which might be potentially dangerous. In addition, some customers may feed their pets, which is not safe for pets.

These service details have become a big label from Fat East. In addition, its single-store profitability has surpassed all the listed companies in the industry, and its net profit has also crushed many head peers. Its founder, Yu Donglai, has been regarded as the "godfather of retail", and he has been collecting apprentices and teaching experience everywhere. One of them is losing money for three years in a row and closing more than 200 stores.

A "fat east" explosion correction was violently promoted within Yonghui.

copy homework

At the end of October, 50 store managers from all over Yonghui quietly came to Xuchang, Henan. They have to learn from the store in Fat East, and rotate to different positions every day, from fresh kitchen to cashier, and learn the management team and store operation with the manager in Fat East. After finishing their studies, they will copy this "Fat East Coming Mode" to Yonghui Supermarket in every detail.

Behind this, Wang Shoucheng took on the heavy responsibility overnight.

On October 31st, Yonghui announced that the post-90s generation, who used to be CEO’s business assistant, was promoted to vice president of the company, and served as the head of the adjustment and reform team in the Donglai learning project of Yonghui Supermarket, leading the construction of the operation standard system and promoting the adjustment and reform project.

In the past 30 days, Wang Shoucheng has moved to Yonghui to change stores. At the age of 33, he has a lot of white hair. At present, Yonghui has opened a total of 14 "Fat East Laihua" stores, including three in Zhengzhou, the hometown of Fat East Laihua, and 11 "Learning Fat East Laihua" independent adjustment stores in Beijing, Xi ‘an, Fuzhou, Chengdu and other cities.

Wang Shoucheng traveled between these stores. On October 31, he had to go to Fuzhou to attend the opening of the store, but he couldn’t make it a few hours before departure because of the typhoon hitting the high-speed rail. Later, he turned to fly to Guangdong, where Shenzhen Yonghui transferred the store to prepare for opening.

Wang Shoucheng, head of the reform team of Yonghui Supermarket (photo: interface news Lu Yibei)

"Learning from the Fat East" is a big and comprehensive goal, and the details need Wang Shoucheng and the team to land.

The first problem to be solved is, which of so many Yonghui supermarkets should be selected for adjustment? Zhengzhou is the first stop, because it is closer to the Fat East and it is more efficient to learn. After leaving Zhengzhou, Wang Shoucheng’s consideration was to choose the city where the headquarters of various provinces, autonomous regions and regions are located.

"In these places, on the one hand, Yonghui Supermarket has a higher market share, and its influence will be greater after opening." In an exclusive interview with Interface News, Wang Shoucheng said, "On the other hand, these places are also the cities where Yonghui regional headquarters are located, and it will be more familiar and easy for our team to transform the first local benchmark store."

In Wang Shoucheng’s vision, after the benchmark stores in the region are opened first, the teams in the local provinces and autonomous regions will roughly know what the logic of learning "Fat East" is, and then the provinces and autonomous regions can gradually independently carry out the adjustment and reform of the second and third stores in the provinces and autonomous regions. Some provinces and regions with strong ability and good conditions can be faster. "In the early stage, we often went on business trips, that is, we had to help the provinces to set up the first store for him first." He said.

But now is not the time for Wang Shoucheng to relax.

On November 8, Wang Shoucheng appeared in Shenzhen Zhuoyuehui Yonghui Store, introducing the differences of this newly opened modified store to visiting guests and the media.

At least visually, it has lost the shadow of Yonghui in the past.

This Yonghui store canceled the stacking of goods in the middle of the main channel of the traditional supermarket. In the retail industry, this aisle can be described as a golden position, because it can catch the attention of consumers first, so it can also sell higher channel display fees. But in Fat East, in order to allow customers to shop and choose goods more freely, it overthrew this tradition.

"In the logic of Fat East, the convenience of customers is the first priority." Wang Shoucheng said.

In addition to canceling the stacking, the Yonghui store after the adjustment also draws lessons from the moving line design from Fat East, so customers must see the cashier line at the first time when they enter the store, instead of letting customers circle the shelves to find the cashier. Wang Shoucheng saw in the store of Pangdonglai that even if it is not the main entrance, Pangdonglai has set up a cashier line, and even if customers buy a bottle of water, they can pay directly.

"In fact, many customers are reluctant to enter the hypermarket because it is too inconvenient." Wang Shoucheng said, "I may only buy a small amount of things before I come out. Let’s go and see if this store is sincere or not, mainly because its cashier line is convenient enough."

In addition, Wang Shoucheng and the team also removed the common hanging flags and bee horns next to the shelves in Yonghui Supermarket. In the past, these loudspeakers repeatedly played the promotion of "30% off the whole audience" or "buy two and get one free". "These settings give customers a feeling that after I entered Yonghui Supermarket, you are trying to get my money. The change shop is a responsive service, and it is not allowed to force customers to buy and force sales. " Wang Shoucheng said.

The design of the store’s moving line is more optimized, and the pile in the middle of the road is cancelled (photo shoot: interface news Lu Yibei)

These details of "copying" the fat east are everywhere in Yonghui’s reform stores.

For example, the overall visual effect of the store has become dark, and the lights in the aisles and ceilings are dimmed, so that the main light is concentrated on the goods, because the products should be lit by lights, so that the whole store is the brightest in principle. It also provides customers with disposable spork, thermal insulation bags, hand washing tables, etc. These very fine but thoughtful services are standard in Pangdonglai.

In the operation of Pangdonglai, its control degree in details is sometimes almost paranoid, and such detailed services can be summarized into 84 items. However, at present, Yonghui has added more than 30 similar services based on different store conditions.

Abandon tradition

In 1998, when Zhang Xuansong and Zhang Xuanning opened the first Yonghui Supermarket near Fuzhou Railway Station, it could let people see the future of local supermarkets in China.

at that timeAnd Carrefour entered the China market with great fanfare. In order to avoid direct competition with them, Yonghui choseLow-cost fresh food with higher consumption frequency has been cut in, and a retail model of relying on fresh food for daily profit has gradually formed. Later, new retail creatures, such as box horse fresh life, also copied the original model of Yonghui Supermarket more or less.

But now, Yonghui, once a pioneer, is no longer the object to be imitated.

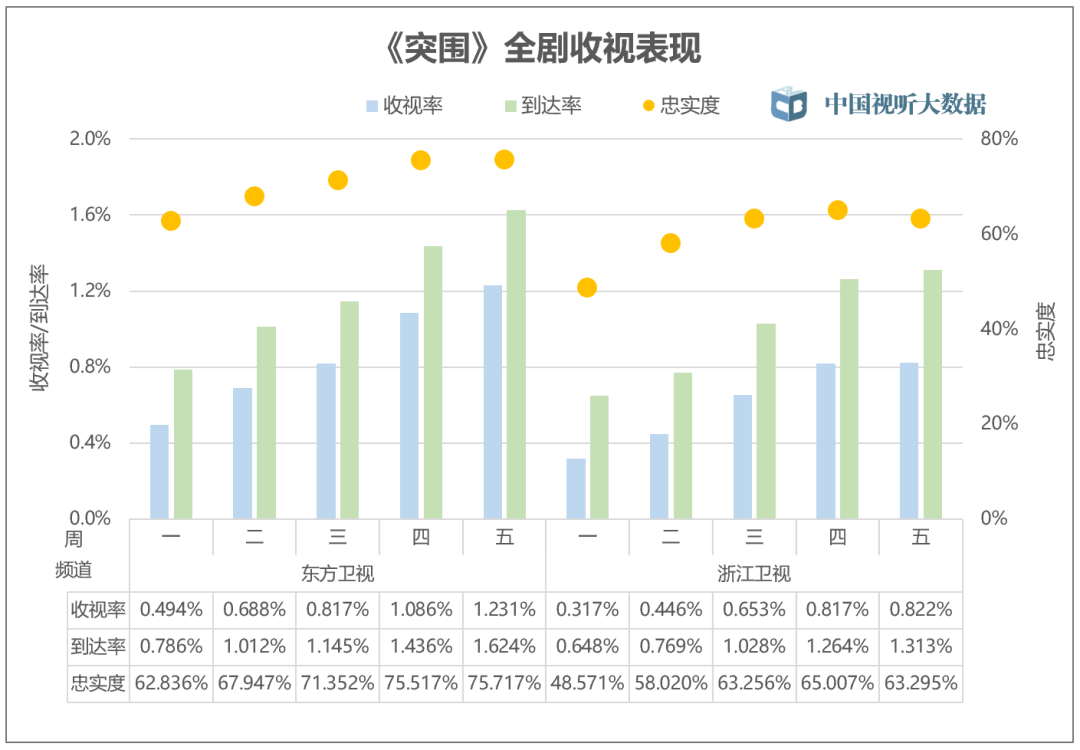

It has been struggling in the quagmire of losses for more than three years, and almost lost all the profits in the past six years. From 2021 to 2023, Yonghui Supermarket lost a total of 8.036 billion yuan, while during the six years from 2015 to 2020, it had accumulated a profit of 8.502 billion yuan.

Chart Making: Interface News He Miao

The golden age of retail hypermarkets has long since disappeared. Carrefour stores have long been few, and 116 stores have been closed in the past five years. Yonghui also made a difficult decision to close 200 stores in 2024.

Wang Shoucheng also knows that some changes in details and services are only superficial, and the key to success or failure lies in commodities and supply chains.

In fact, the chronic illness of Yonghui Supermarket and similar traditional retail lies in the aging of business model.

Specifically, supermarkets and retailers such as Yonghui only provide channels, and charge channel fees to brands and suppliers to make profits by "selling shelves". For example, the top positions of shelves and piles in supermarkets are sold to brands, and new products from suppliers are charged new product fees, entrance fees and exhibition fees. If these new products are not further paid, the goods are often hidden in a deeper position. After entering the store, if the gross profit and sales data within three months are not ideal, it will be eliminated by the store.

As a result, even if the brand keeps introducing new products, but the suppliers can’t get enough good bunks, these products can’t become explosions or even be removed from the shelves. In addition to the promotion expenses, suppliers have to bear the pressure of prepayment. In recent years, conflicts between channels and brands often break out, which leads to a certain brand’s products choosing to withdraw from a regional supermarket channel.

In the end, in this mode, suppliers can only add extra fees to the price of goods, which leads to inflated prices of hypermarkets, homogenization of goods, inefficiency of stores, and even corruption in store procurement.

"For suppliers, products go through factories, distributors and KA systems (that is, the main retail channels). Later, it was found that this model basically did not make money, and the profits were taken away by retail stores." A juice producer told Interface News.

Yonghui decided to break this pattern and completely "de-KA" like Fat East.

The core of de-KA is that retail brands directly participate in products, and some high-quality suppliers are selected to enter the store through OEM or co-branding. "In the negotiation process, the supplier will take the cost of entering the channel as a bargaining chip. After reaching the final cooperation, the retailer promises that there will be no entrance fee and bar code fee, and it will not be returned, and the price is more advantageous." The above manufacturer said.

For example, in Yonghui Supermarket after the reform, you can see the cooperation between "Yonghui Youxuan" series of small hanging pear soup and juice brand Leyuan, the cooperation between glutinous dumplings and Sanquan, and the cooperation between roll paper and Vida brand; In addition, there are two brands, Panpan,Well-known brands such as Lux. In fact, this model is not difficult to see in Fat Donglai and another topical retail brand Oleqi.

"Yonghui Optimization" series (photo shoot: interface news Lu Yibei)

"After each store in Yonghui is restructured, the entire product structure may be replaced to about 70%, so that the product structure can reach a structure close to that of Fat East, and the gross profit can be earned reasonably by commodity power, instead of earning gross profit by collecting background fees." Wang Shoucheng told the interface news.

The pain caused by this change is very direct.

The change store no longer makes profits through channel fees, which directly affects the overall gross profit of Yonghui. Yonghui Supermarket’s comprehensive gross profit margin in the first three quarters was 20.84%, a decrease of 0.79 percentage points compared with the same period of last year, of which the gross profit margin in the third quarter was 19.19%, a decrease of 1.69 percentage points compared with the same period of last year.

But what Yonghui needs to learn is the retail principle of cooperation between Fat East and suppliers.

Zheng Tongjian is the senior vice president of Leyuan Health. He started to cooperate with Yonghui when he tried to make his own brand "Master Chan". But in the dual-brand cooperation mode, he can clearly feel the difference.

"Under this model, the two brands can form a cohesive force, and Yonghui will also tilt its resources to the co-branded products on display." He told Interface News, "Juice products with the same content and quality can achieve an absolute advantage in price, and consumers have brought them some positive feedback in the process of adjustment and reform." After the cooperation, the sales volume of this category exceeded the expectations of both parties.

This dual-brand cooperation mode is also more efficient than Yonghui’s previous mode of independently running its own brand.

A self-owned brand OEM who has worked with Yonghui told the interface news that Yonghui’s own brand was an independent department before, covering many sub-brands, such as Master Chan, Tianqu and Yousong. However, in his view, Yonghui’s own brand operation mode itself has problems.

"The category of private brands adopts the centralized system of headquarters, and there is a price increase rate from headquarters to stores, so many stores are smashed when they purchase goods from the general warehouse." He told the interface news, "this makes the competitiveness and execution of the goods not in place after they finally arrive at the store, and in addition, the separate business department is beneficial to the assessment of embellishment and sales." This profit-seeking model was cancelled only this year with Yonghui’s cancellation of its own brand department.

In the process of reform, Yonghui also intends to select some suppliers from Fat East for dual-brand cooperation. For example, some suppliers of "Yonghui Youxuan" are also suppliers from Fat East, or choose partners according to the standards of Fat East. When developing these products, Yonghui’s own brand team went directly to Xuchang to work with the team from Fat East.

Yonghui Club intends to select some suppliers from Fat East for dual-brand cooperation (photo shoot: interface news Zhao Xiaojuan)

Wang Shoucheng also stressed that it needs patience to develop its own brand. Besides dual-brand operation, its own brand is still Yonghui’s commodity strategy to explore the commodity supply chain. Due to the effect of Fat Donglai, at present, enzyme laundry detergent and paper towels such as Yonghui Store all come from the same supplier as Fat Donglai, including pig’s trotters and cooperative factories from Fat Donglai.

For example, he told Interface News that when Fat Dong came to develop beer, he would tell the supplier that I would give up one more point to improve the product quality, while the traditional retailer’s approach may be that when the product sells well in the store, there is often the idea of deducting one more point.

A retail industry practitioner also told the interface news that Fat Donglai has extreme requirements for products. According to his understanding, the team that developed its own brand of bean paste before Fat Donglai sought a bean paste production factory that met their requirements all over the country, but after half a year, they didn’t find one that could match the requirements of Fat Donglai, so they simply gave up this single product instead of finding a manufacturer to do it for development.

Chart Making: Interface News He Miao

Get rid of "class flavor"

Huang Lihua recently learned to make up.

She is a clerk in the fruit and vegetable area of Mentougou, Yonghui Supermarket in Beijing. This store has already started its operation before the headquarters went off to carry out the transformation of Fat East. One of the requirements is that female employees require make-up, and their hair needs to be wrapped so that bangs can’t fall off. On the fruit and vegetable cabinets that she is responsible for, there should be no products that have been hurt or pinched after being picked by customers. The ground should also be clean and sanitary, and there should be no stains, water or other garbage.

Like Fat Donglai, these standards all come from an assessment card with five colors. When the store manager or regional head checks, they will be graded according to the color according to the performance.

The service praised by people from Fat East is supported by such a detailed assessment standard. In order to make employees fully engaged, Yu Donglai will instill various values about human civilization, fraternity and so on, and provide more generous returns more directly. In 2009, Yu Donglai even bought 70 houses and distributed them to the management at or above the division level, thus basically solving all their housing problems. Part of the hot search from Fat East is about the salary and benefits enjoyed by its employees.

In this tide of adjustment and reform, Huang Lihua’s salary has also increased from 4,000 yuan to 5,300 yuan now. In the benchmark shop, the salary of the clerk has reached 6000 yuan.

However, Wang Shoucheng found that raising wages may not be able to achieve the same effect as Fat East.

"To tell the truth, the fourth-tier cities in Xuchang offer 8,000 yuan, while we only have 6,000 yuan in the first-tier cities. The money you gave him is actually not that high. Why do you ask him to achieve all the standard movements? The employees themselves have not felt the beauty. How is it possible for you to let me pass on the beauty?" Wang Shoucheng told the interface news.

When he visited the store in Pangdong, he intuitively felt the gap.

In Yonghui’s fruit store, there may be only three or four categories of grapefruit, but it can be subdivided into eight categories in Pangdonglai. For example, only red-heart pomelo can be divided into three pieces: peeled red-heart pomelo, mini-boxed red-heart pomelo and peeled red-heart pomelo. In the next tasting area, from left to right, there are toothpicks, tasting boxes, wet tissues and dry tissues. These details are all spontaneously thought out by grassroots employees. "It is really enviable that they can focus on and think about how to make the products more suitable for customers’ needs in the store." He said.

Wang Shoucheng began to think about what went wrong. He observed in Pangdonglai that when Yu Donglai was touring the store, he would stand at the entrance for 5 minutes and 10 minutes to observe everyone’s working conditions. If he saw that everyone was working in a very orderly and happy atmosphere, the operation of the store would not be too bad.

"When I come back to me, sometimes I see the employees are as tired and unhappy as fighting. It is impossible for you to let him see the customers smiling at once as soon as he looks back." Wang Shoucheng said.

So in the process of adjustment and reform, Wang Shoucheng asked the team and store managers to implement the layout of the backcourt adjustment first, so that employees can have a place to rest and eat. There is a good office environment, and employees can relax themselves when they return to the backcourt.

When Yu Donglai came to inspect, he directly pointed out this problem. "Employees should go back to rest at least half a day or one day in advance, take a shower and sleep well, and will be in good condition to come to work the next day." Now, in Yonghui’s reform store, some employees in the food department store area can get off work at 2 pm, while some fresh employees work until around 4 pm because of replenishment.

Wang Shoucheng also admitted that Yonghui’s current salary of 6,000 yuan is objectively not enough for the clerk to provide the original "Fat East" service. "Don’t feel like giving the employee a raise. What will happen to this employee? This is impossible. It is just a starting point, which is a condition to show your sincere and equal respect for employees. "

cost account

Even if the welfare of employees is not completely consistent with the standards of Fat East, the adjustment and reform is a huge pressure for Yonghui, which has suffered losses for three years.

The information obtained by Interface News from an investor exchange book shows that at present, the cost of Yonghui’s store renovation is 5 million yuan. However, Wang Shoucheng told the interface news that the conditions and facilities for changing stores are different, and the cost is also different. The renovation cost of some stores will exceed 5 million yuan.

But Yonghui was cruel this time. Wang Shoucheng has a firm attitude. "We must change the store to make money, at least to ensure the salary income of employees, and then the profit will be further improved as the team matures. But we will give you a time, including personnel and goods, and we have made great improvements. At present, everyone understands this direction, unlike the previous system and model that did some useless work. "

But Yonghui needs too many places for money this year. In addition to the adjustment, Yonghui is stopping losses by closing stores this year. As of November 13th, the number of stores in Yonghui official website has been updated to 801, which is 199 fewer than the number of 1,000 at the end of 2023. That is to say, in the past 10 and a half months, Yonghui has closed nearly one-fifth of its stores.

Closing the store involves rent withdrawal, rent compensation, employee compensation, supplier payment settlement, etc., which will generate a large amount of capital demand.

To this end, Yonghui began to pay back by selling assets in December last year, and Yonghui sold its holdings in Chengdu.10% of the shares of a joint stock limited company, with 799 million yuan; In April, it received a price of 378 million yuan from the transfer equity of its subsidiary Yonghui Yunjin Technology Co., Ltd..

Yonghui, who was forced into a hurry, also began to collect debts.

At present, a large sum of money from Yonghui comes from the transfer price of Wanda Commercial Management shares held by Yonghui of 4.53 billion yuan, but the recovery of this transaction is not smooth, and the payers Dalian Yujin Trading Co., Ltd., Wang Jianlin, Sun Xishuang and Dalian Yifang Group have defaulted only after paying 890 million yuan. Yonghui filed an arbitration with Shanghai International Economic and Trade Arbitration Commission in October this year, and the arbitration has not yet made progress.

But Wang Shoucheng is optimistic.

In the dimension of return on investment, he said that he focused on two aspects, one is human efficiency, and the other is human cost rate. Human effect is the average sales per person per day, which is used to measure the efficiency of labor output. The labor cost rate is the proportion of labor cost in turnover. If the growth rate of human efficiency is greater than the growth rate of labor cost rate, it shows that the current labor input cost is worthwhile.

According to Wang Shoucheng’s disclosure, it’s only one month or two after the store is changed, and its labor cost rate is close to that before the change, and some of them are even lower than the original labor cost rate. This is because the index of human efficiency has improved. "Compared with the human effect of 6,000-7,000 yuan from Fat East, Yonghui has only 3,000 yuan, and some stores have less than 3,000 yuan, but it is 30% higher than before."

At present, Yonghui’s human efficiency still has room for improvement. If the mature employees can reach 4,000 yuan in the later period, it will further accelerate the cost recovery cycle.

From the performance point of view, learning from the fat east really attracted customers back-at least in the early days of opening.

According to the official data disclosed by Yonghui, Shenzhen Zhuo Yue Hui Store, which opened on November 8, attracted a large number of consumers from Guangdong, Hong Kong and Macao to experience it. In three days, the consumption passenger flow exceeded 50,000, and the sales volume was about 5.5 million yuan. The average daily consumption passenger flow was about 4.2 times that before the reform, and the average daily sales volume was about 8 times that before the reform.

The first Yonghui store in Beijing, "Shijingshan Xilongduo Store", paid about 14,000 passengers on the first day, and over 50,000 people entered the supermarket. The total daily sales reached 1.7 million yuan, which was six times more than the average sales the day before the reform. In the base camp of Pangdonglai, Yonghui also performed well. After the reform of Zhengzhou Xinwan Plaza Store, Yonghui Supermarket sold 58.35 million yuan in July, and the average daily sales reached 1.87 million yuan, which was 13.9 times of the average daily sales before the reform.

The ultra-high sales generated by the continuous adjustment and reform will basically make it easier for stores to recover their costs in the early days of opening.

According to the above investment exchange report, if Yonghui stores can reach an average daily price of 500,000 yuan, it will basically reach a break-even point. At present, most of Yonghui’s restructured stores can reach the level of 800,000-900,000 yuan after the initial peak daily sales, which has exceeded the expectations before the restructuring.

If this effect can continue, Wang Shoucheng will have a greater say in property negotiations, further reducing costs.

For example, Wang Shoucheng said that the property owner of Fuzhou Changle Wanxing Store invited Yonghui to adjust this store, and took out the sincerity of reducing the rent by 50%, in order to be optimistic about the continuous passenger flow that Yonghui brought to the shopping center after the adjustment.

However, the giant still needs the cooperation of every joint when turning around, and Yonghui is not smooth everywhere in the process of adjustment and reform.

A middle-level manager of Shanxi supermarket who once went to study in Pangdong told the interface news that the adjustment and reform needed the overall linkage from top to bottom. "Although the wages of employees have increased, the requirements have also increased accordingly. Many store-level managers still manage employees in the old way, and even cause some employees to vomit." He said.

It is also a challenge to copy the success of the benchmark store to the regular store. According to his observation, a Yonghui supermarket in Taiyuan, Shanxi Province also made a low-key internal adjustment, but because it didn’t sell the brand products of Fat Donglai, the customer flow in that store was sparse. More changes before the adjustment were that the floor was clean and the goods were neat, and the rest did not change much-and this may be the status quo of most stores in Yonghui.

These phenomena are also seen by Wang Shoucheng.

"Of course, we are still in the stage of learning from the fat east, and we are still far from the standard of coming from the east." He said, "But now, even if we make a little progress every day, it will be much better than in the past."

At the critical moment of reform, the appearance of Ye Guofu gave Wang Shoucheng and Yonghui confidence.

September 23rd, Ye Guofu.Signed an agreement with some shareholders of Yonghui Supermarket to acquire 29.4% of the latter. That evening, Ye Guofu said to investors on the telephone conference, "I will never do anything wrong in retail, and many people can’t understand it. I think this is the best opportunity."

However, the market doesn’t think so. On the day of the transaction announcement, the stock price plummeted by 16.65%.

There are many questions about Ye Guofu and Yonghui. For example, the number of stores that accept the adjustment from Fat East is too small and the sample size is insufficient; In addition, it is doubtful whether the "magic" from Fat East can continue to play its role, and whether it will be too rash to buy shares through listed companies.

Ye Guofu is quite convinced of this. He has expressed his approval for Yonghui’s reform in telephone conferences, personal circle of friends and media interviews. He even bluntly said that in the past, Yonghui’s attempts to be a community store, a green label store, a member store and a super species all failed because the direction was wrong. Now, the adjustment from the fat east is effective.

"In the past ten years, I have traveled all over the world and seen various retail formats and models. I found that the better retail model than Costco, Sam and Trader Joes was originally in China, that is, the Fat East model." Ye Guofu said. He believes that the "Fat East" model is the only way out for supermarkets in China.

After taking a stake in Yonghui, this massive reform is still advancing in the voice of doubt. After the opening of each modified store, Yonghui Supermarket will also disclose its business data in a high-profile manner.

A month later, when Ye Guofu appeared in front of the public again, he didn’t have the urgency to explain himself to the public in September, but he said with some pride, "People in the whole society are saying that I am very lucky and have taken every step right."

However, it will take some time to decide whether it is the right step to take a stake in Yonghui.